Many municipalities throughout Ohio have announced their opposition to House Bill 5 because of its financial impacts on city budgets resulting in reductions of city personnel.

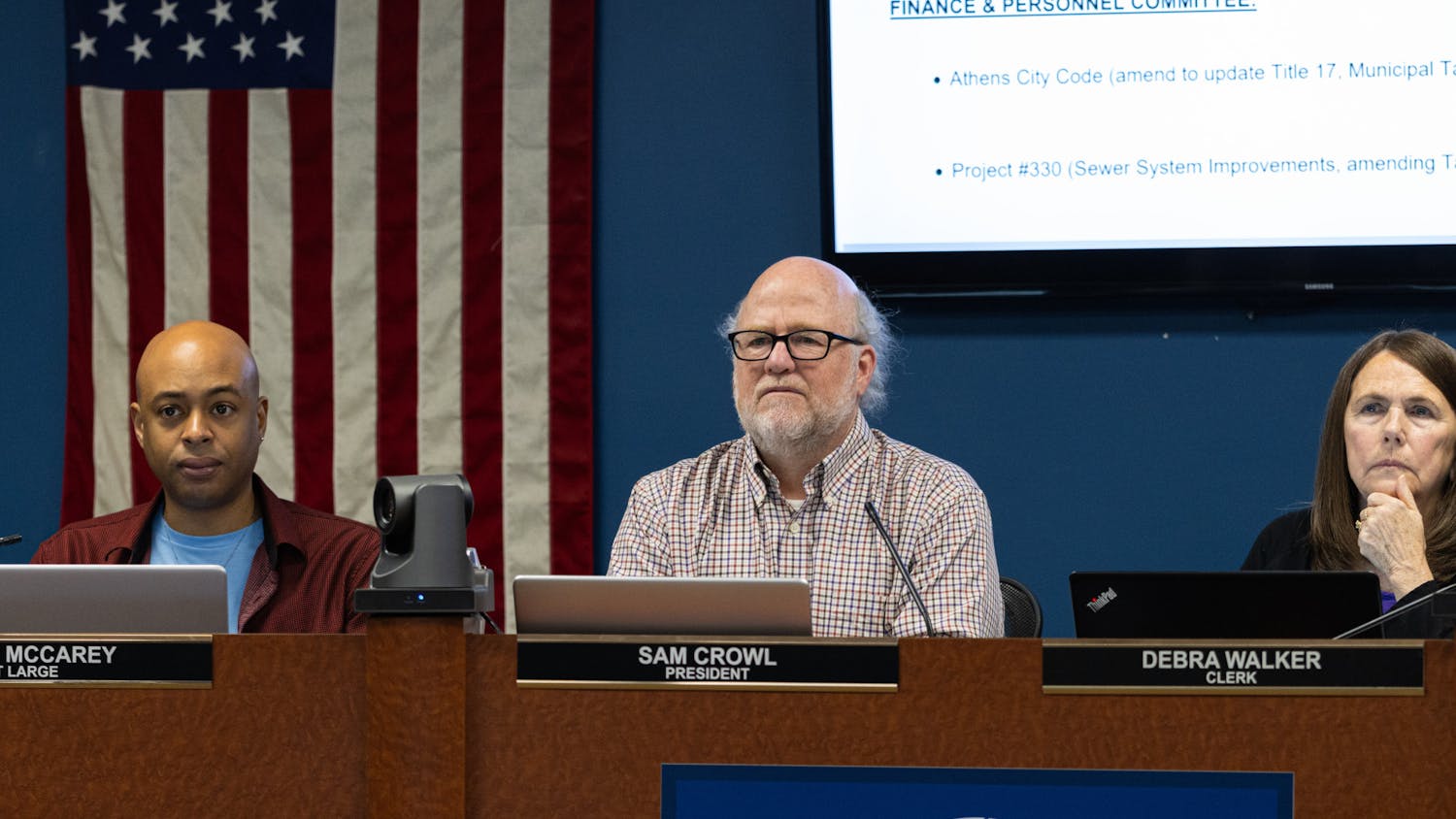

Athens joined those opposing the bill by unanimously passing a resolution against its passage by state legislators at the March 4 Athens City Council meeting.

House Bill 5 proposes several tax uniformity rules that could potentially cost the city of Athens more than $200,000 per year from the city’s general fund.

Reductions in police, fire and street-maintenance personnel would most likely result from passage of the bill, because more than 70 percent of the city’s budget is for city personnel, said Councilwoman Chris Knisely, D-at large.

“With funds and budgets as tight as they are, I think it’s worthwhile to support this resolution to oppose House Bill 5 to prevent further loss of municipal funds,” Knisely said.

In addition to potentially losing about $200,000 per year because of HB 5, Athens loses about $1 million in local government funds, estate taxes and tangible personal property tax annually, she said.

Councilman Jeff Risner, D-2nd Ward, agreed with Knisely at Monday’s meeting.

“This seems to be another state government power grab to take more power away from the local communities and consolidate it at the state level,” Risner said. “I completely support this resolution.”

Potential loss of revenue is not the only concern City Income Tax Administrator Tina Timberman has — one of her main concerns is about the bill’s change to tax withholding.

Athens currently has a law that says if a person works in the city for more than 12 days per year, he or she is required to pay taxes here. However, if HB 5 passes, taxes won’t be withheld for 20 weekdays.

“We’re not trying to pick up every single person who comes in here every single day,” Timberman said. “Our main issue is when the construction company comes in and doesn’t have to pay taxes for the first month. Thousands of dollars are lost.”

In addition, Timberman also said that HB 5 is long, wordy and complex.

She said the bill tries to make all the due dates uniform. However, a partnership is allowed to have an extra 15 days to file.

“That’s in the front part of the bill,” she said. “Under extensions, nowhere does it say that partnerships have until Oct. 31 to file instead of Oct. 15. They don’t reference each other.”

HB 5 is eliminating taxes for the businesses and putting the burden back on the individuals. Though Timberman the city is not coming out and saying that taxes will be raised, if HB 5 is passed the city would have to make changes to offset the revenue loss.

“Something (would have) to be cut or more revenue (would have) to be generated,” she said.

kh547011@ohiou.edu