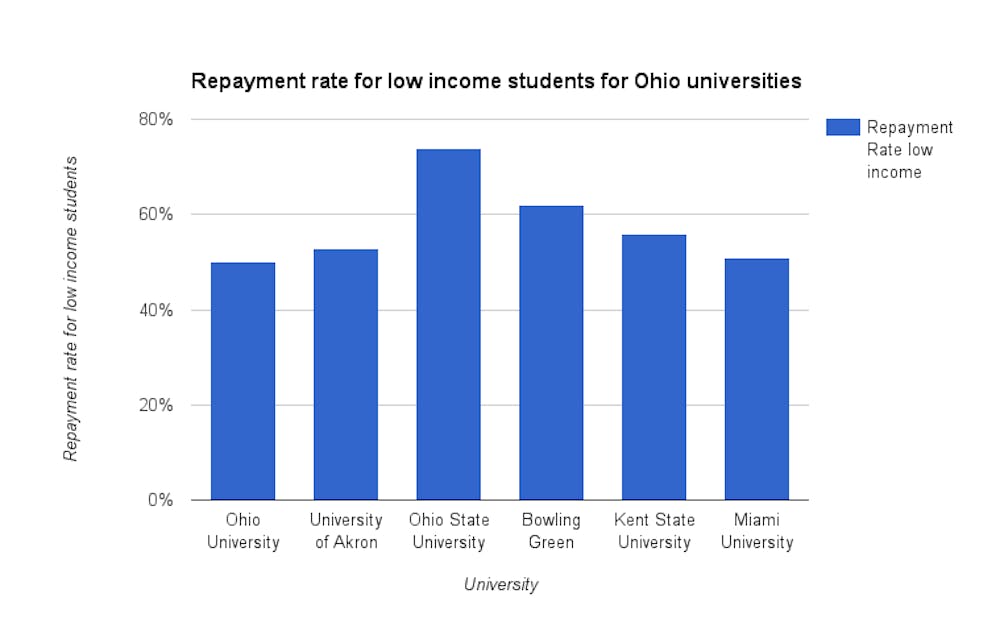

Of the Ohio University students whose family income is less than $30,000 per year, half were not successful in decreasing their student loan balance three years after entering repayment.

A higher percentage of students from University of Akron, Bowling Green State University, Kent State University and Miami University had decreased their loan balance and had not defaulted, according to a database provided to members of Investigative Reporters and Editors, an organization dedicated to investigative and data-driven journalism.

“I know I’m going to have a hefty student loan balance when I get out of college, and I know I’m not going to be able to pay it off right away,” Haley Jones, a junior studying

She said she will need to take an exam to become a certified child life specialist before she can begin applying for jobs.

“I don’t know what’s going to happen during that time," Jones said. "It’s really scary knowing I’ll come out of college (in debt) and probably not get a job right away.”

The database, designed to analyze student loan and finance data across multiple categories, also provides repayment rates for first-generation students, Pell Grant

Ohio University, with a loan repayment rate of 63 percent for first-generation students, fell short compared to schools of a similar size, such as Akron and Miami, which had a loan repayment rate of 65 percent, and Kent State, which had a loan repayment rate of 67 percent. BGSU and the Ohio State University topped the list with 74 percent and 80 percent repayment rates, respectively.

Rachael Stevens, a sophomore studying speech language therapy, said being able to repay student loans may be a problem for some graduates. She joined the Army ROTC program to avoid incurring a large student loan balance, she said.

“I think (student debt is) a problem, but I don’t really have a way to fix it,” Stevens said.

OU also had lower repayment rates than Akron, Miami, Kent State, BGSU and OSU for students who did not complete their degrees, and for those who received Pell Grants — a form of financial aid that is disbursed by the federal government and does not have to be repaid.

Though OU's repayment rates were lower than other colleges in the state, the university also had a higher percentage of part-time students, according to the database.

With 27 percent of the student body enrolled part-time, OU easily leads when compared to similar schools in that category. Kent State has the second-highest percentage of part-time students, at 18 percent.

“We do specifically recruit these students through online marketing, on ground regular daily visits to community colleges and hospital organizations, and throughout Southeast Ohio at our Regional Campuses,” Craig Cornell, senior vice provost for Strategic Enrollment Management, said of Ohio University’s part-time students in an email.

He said educational opportunities such as regional campus locations and night time, weekend and online classes developed with part-time students in mind make OU attractive to that group of students.

“This is fundamental to our campus culture,” Cornell said in an email.