Correction appended.

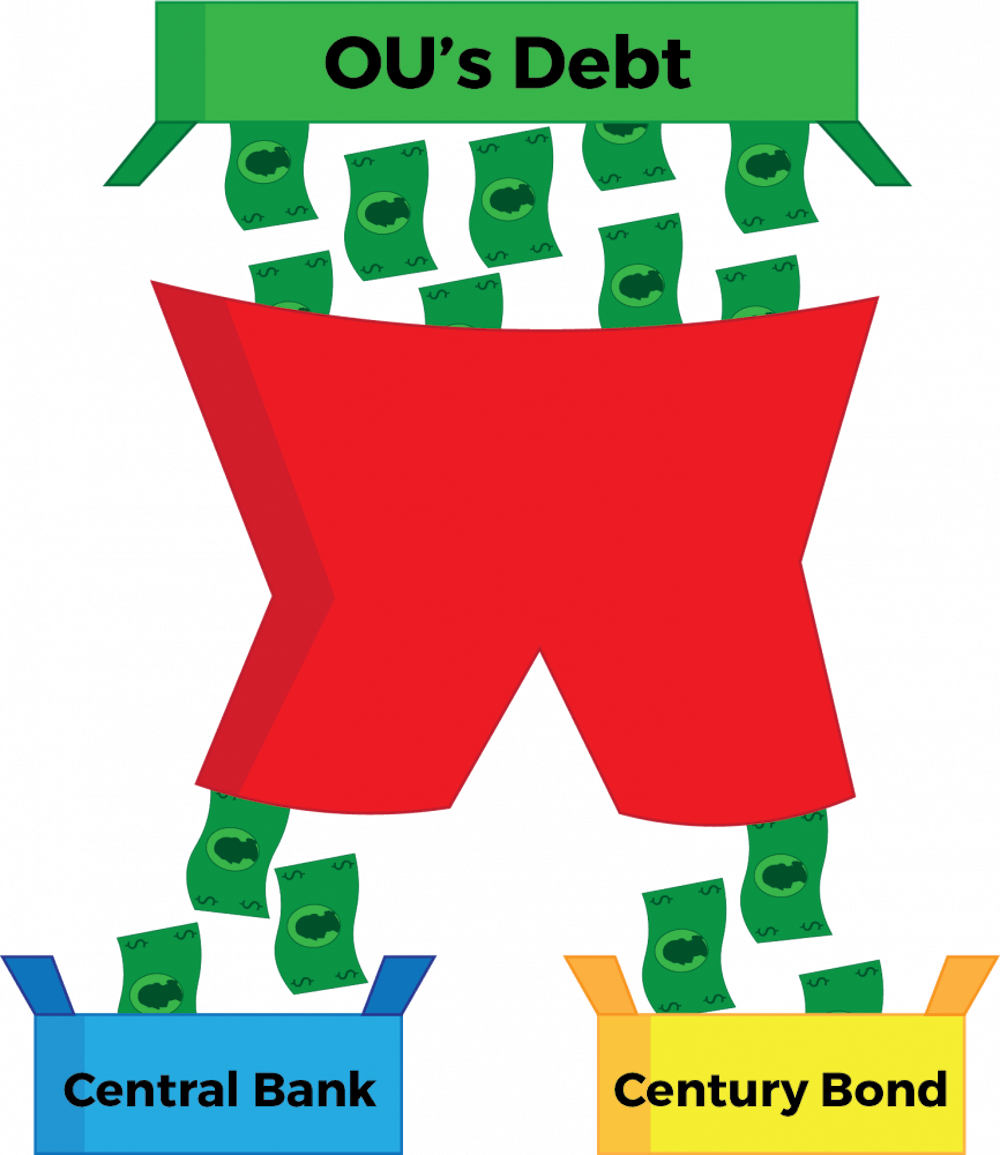

Ohio University has $626.4 million in outstanding debt as of June 2017 and each year, internal loans and external payments help maintain low interest rates and allow the university to continue spending.

According to the 2017-2018 Budget Book, OU’s Internal Bank and Century Bond allows internal loans to pay off OU’s external debt service. Internal loans also allow the university to reinvest existing funds into university infrastructure, which reduces the amount of funds taken out for major projects.

The university reinvests funds by issuing internal debt to finance facilities and infrastructure investments.

In order to further combat an increase of debt while addressing long-deferred building maintenance and energy infrastructure projects, OU issued a $250 million taxable Century Bond through collaboration with internationally-recognized investment banks in 2014.

That bond regulates annual interest payments and will not reach principal bullet maturity until 2114, making it mature about three times slower than typical bonds. That also makes it easier for departments to compensate spending.

One goal of the Century Bond is to recycle funds internally in order to reduce the amount of need for future external debt while paying off existing debt. The model aims for that by using the Central Bank to reinvest existing funds into OU’s infrastructure.

Revenue from the Century Bond created the Century Bond Bank so that individual colleges, departments and planning units can borrow from the bank to complete building renovations as well as repay the loans with interest over time. OU and the Board of Trustees manage the Central Bank.

The Central Bank’s primary use is to pump money back into OU’s Capital Improvement Plan (CIP). The CIP helps the Budget Planning Council’s plan and provide recommendations for how much debt will increase in the coming years.

Although the debt is projected to increase and peak at $760.9 million in fiscal year 2021, the amount of financial reserve and the size of the university’s operations are crucial to consider. So debt is still increasing, but the university loses less money because the Central Bank operates on a calculated average to determine interest.

The Central Bank and the Century Bond method create the privatization of loans.

OU uses internal banking models because it allows the interest rate to be based on the blended average cost of the institution’s overall debt portfolio. That makes the interest on debt the same across departments and it also creates predictability in capital costs and working capital returns, two main factors in the budget-making process.

Correction: A previous version of this report incorrectly identified how the university can continue spending, the Internal Bank, what proceeds created the Century Bond Bank and the debt's market sensitivity. The article has been updated to reflect the most accurate information.

Clarification: The article has been updated to clarify the CIP's role in budget planning.